CPAs are trusted advisors. That means they’re often the first to hear when a client is thinking about a sale or restructuring. By having a pulse on sector valuations, a CPA can engage in those conversations with confidence. To help, Viking is committed to providing market-leading transaction insights. Here, we analyzed our most recent 100 transactions. Based on that data, we’re sharing a closer look at five industries shaping today’s lower middle market and what it could mean for your clients.

Sector Snapshot

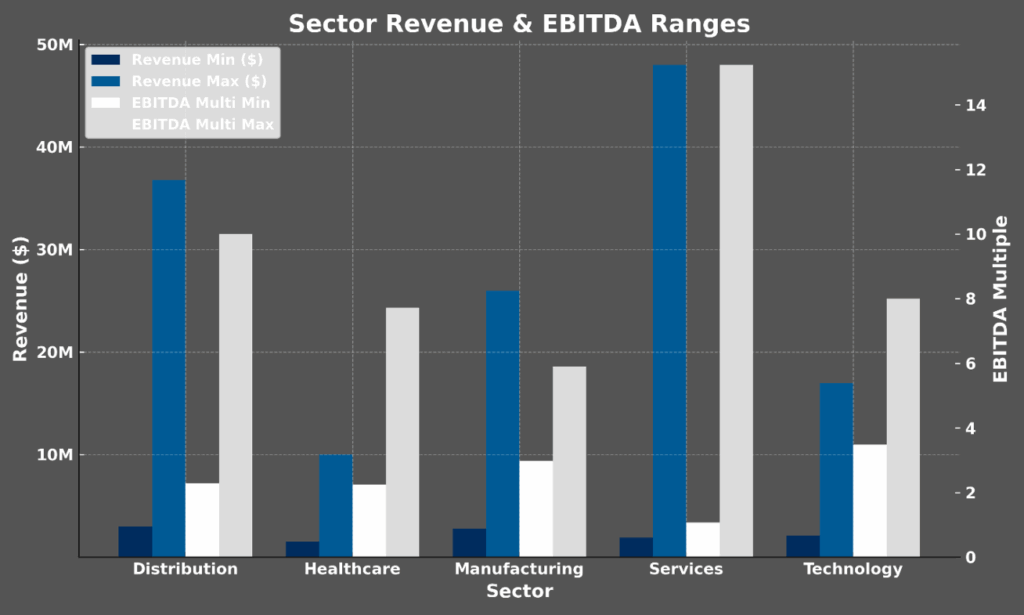

The chart below illustrates revenue and EBITDA multiple ranges across five key sectors: distribution, healthcare, manufacturing, services, and technology. The revenue bars highlight the minimum and maximum transaction values, while the EBITDA bars show the corresponding valuation multiples. This side-by-side comparison provides a clear snapshot of sector performance in market positioning.

Market at a Glance

Distribution Sector

- $3M–$37M revenue

- 2.3–10x EBITDA multiples

- E-commerce growth, tech adoption, and supply chain shifts continue to drive strong demand.

Healthcare Sector

- $1.5M–$9.5M revenue

- 2.3–7.7x EBITDA multiples

- Demand is fueled by demographic trends, regulatory shifts, and ongoing investment in healthcare technology and services.

Manufacturing Sector

- $2.8M–$26M revenue

- 3–6x EBITDA multiples

- Investments in automation, digital transformation, and domestic supply chain resilience are keeping valuations steady.

Services Sector

- $2M–$47.5M revenue

- 1.1–15.2x EBITDA multiples

- Buyers are paying premiums for businesses with recurring revenue, scalable operations, and strong reputations.

Technology Sector

- $2.1M–$17M revenue

- 3.5–8x EBITDA multiples

- Managed IT, SaaS, and AI-driven solutions remain investor favorites thanks to innovation and recurring revenue models.

What This Means for Your Clients

A few themes cut across industries:

- Recurring revenue matters. Buyers consistently place the highest valuations on companies with predictable, contract-based income.

- Technology is a differentiator. From SaaS to automation, efficiency-driving tools are a factor in nearly every sector’s premium multiples.

- The market is active. Owners considering an exit in the next 12–24 months may find today’s environment particularly favorable, especially in sectors positioned for long-term growth.

Helping Clients Capture Value

Whether your clients are considering a sale, preparing for succession, or exploring new partnerships, understanding current market multiples is essential. Viking M&A works alongside CPAs to provide transaction insights, valuations, and strategies that maximize opportunity. Together, we can help business owners realize the full potential of their hard work.